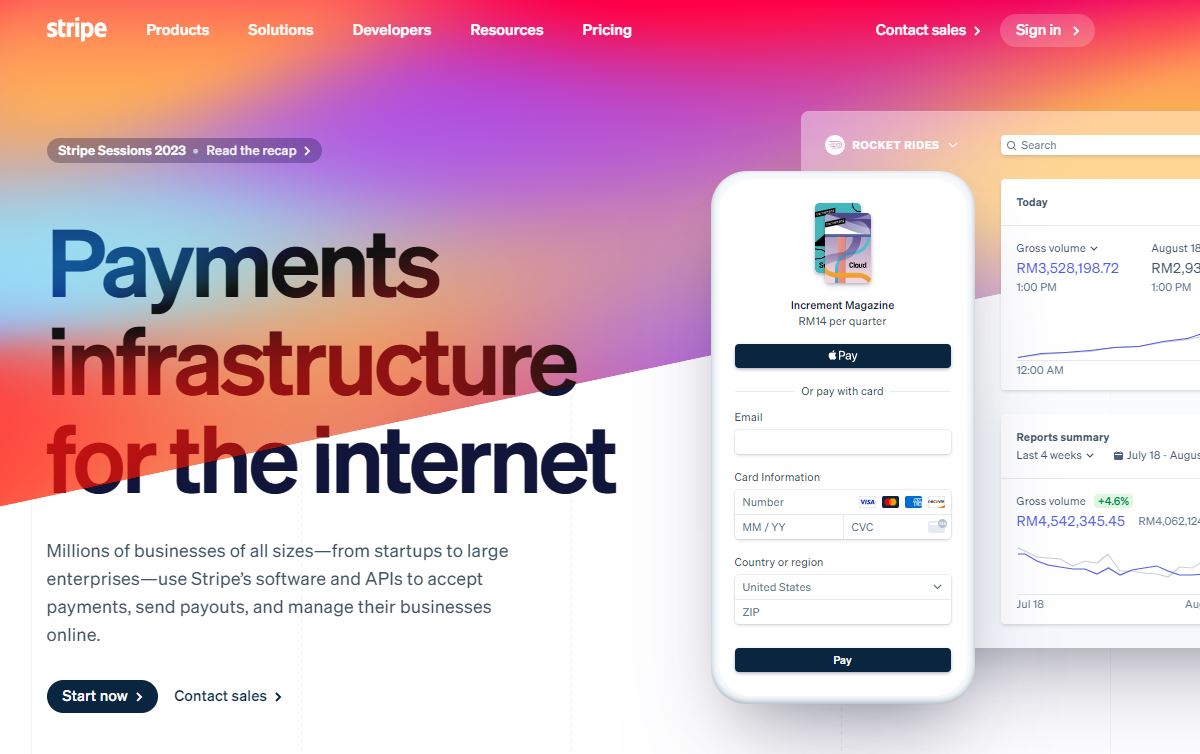

Explore how Stripe can transform your e-commerce platform with secure, flexible payment options. Learn to accept international payments, offer multiple payment methods, and seamlessly integrate Stripe into your online store for an enhanced customer experience.

The fashion industry’s business model is one based upon planned obsolescence. Each season thousands of fashion brands introduce whole new collections, and major shifts in

The Lemonade Crypto Climate Coalition wants to use smart contracts to basically automate the payout process for subsistence farmers. Climate change is creating a nightmare

Add financial wizardry to your entrepreneurial repertoire with these cost-reduction tips. One of the major benefits of having a home based business is the low

Just because you’re staying at home watching a little one doesn’t mean that you can’t make some full-time cash. Being a stay-at-home parent can actually